Pet insurance and the wonderful business of Trupanion

A closer look at the pet insurance industry and the business of Trupanion (TRUP)

Welcome to the Rafiki Capital Newsletter! I spend my free time dissecting business models to bet on outcomes and use this newsletter as a means of sharing my findings.

If you’re reading this but haven’t subscribed, I hope you consider joining me on this journey.

Introduction

Imagine yourself at the veterinarian. You’re there because your 6 year old golden retriever, Max, just doesn’t seem like himself. After completing her diagnostic, the vet informs you that Max has a brain tumour. You are shocked, especially given that your dog has never gotten sick before. But before you can fully react to the situation, the vet assures you that there are treatments available.

The vet continues to list some procedures that her team can get started on right away. Her list causes you to panic even more - your mind is now split between wanting what is best for your pet and the financial burden you will have to take on. At the end of the meeting, you glance over at Max once again and decide to proceed with the vet’s recommended multi-session treatment.

The first session begins right away and you are handed an invoice of $5,000. On your drive home, you can’t stop thinking about your stretched finances and realize that this first $5,000 you just charged to your credit-card is much greater than the cumulative amount you would have paid for pet insurance. You instantly regret opting out 6 years ago.

The situation outlined above is not unique. In fact, it is a common scenario faced by the owners of the 120 million pets that visit the veterinarian every year. Pet humanization has led us to seek more advanced care for our pets, and as a result, veterinary costs continue to mount. Rising pet-care costs also means rising cases of economic euthanasia - nearly two-thirds of the pets put to sleep every week are euthanized for economic reasons. To avoid falling into the hypothetical situation noted above, many pet owners are now turning to pet insurance to help budget and care for their pets.

Pet insurance is not a new concept, but it has struggled to take off in North America. It is estimated that only about 3% of pet owners in North America have pet insurance. Investors have taken note of these dynamics and are now trying to figure out whether pet insurance penetration in North America will rise to similar levels seen in European markets. Some have even piled into Trupanion, the second largest pet insurer in North America. Trupanion can be viewed as the “Apple” of pet insurance, as it has revolutionized how we think about pet care.

The following note takes a dive into the pet insurance industry, followed by an overview of Trupanion. The note also includes my estimate of Trupanion’s share value. Pet insurance is a hot space - an industry worth keeping a close eye on.

The concept of pet insurance

Across the world, pet ownership continues to rise. In the United States for example, over 70% of households now own at least one pet. This growth in pet ownership has been further led by the COVID-19 pandemic, as many people stuck inside of their homes, seeking a companion, have adopted their first pet. Not only are we adopting more pets, but we are also treating them more like people (i.e. pet humanization). As these trends continue to evolve, demand for pet-related products and services has sky rocketed. One sector that has benefited from this shifting behaviour is pet insurance.

The concept of pet insurance is not new. In fact, the first policy was written in 1890 by Claes Virgin, founder of Länsförsäkrings Alliance, a Swedish insurance company that is still around today. The original policies extended to horses and livestock and eventually evolved to cover households pets such as cats and dogs. By 1947, the first pet insurance policy was sold in Britain. Pet insurance eventually made its way to the United States in 1982, when Veterinary Pet Insurance (VPI), a subsidiary of Nationwide, underwrote a policy for the famous TV dog, Lassie. Shortly after, pet insurance products began showing up in the Canadian market in 1989.

Pet insurance reimburses the policy holder for unexpected medical expenses that may arise as part of owning a pet. In the event of a surprise accident or illness, having pet insurance coverage can protect the policy holder’s finances. In exchange for this peace of mind, policy holders pay a monthly premium to the insurance provider. The monthly premium varies widely and depends on a range of factors, including the type of pet, age, and local costs. In most cases, the younger the pet, the lower the monthly premium - a pre-existing condition can have a significant impact on premiums. On average, dog insurance can cost $45-$85 per month, while cat insurance can cost an average of $30 - $50 per month. Monthly premiums are also often adjusted by providers (usually annually) to reflect the local realities. While these monthly premiums can add up to a few hundred dollars per year, the benefit of pet insurance is that cost will be less of a factor when deciding whether to go through with a major procedure.

Although pet insurance seems more like human health insurance, it is actually considered a segment of property and casualty (P&C) insurance. Claims are typically paid out after some policy specific criteria is met. For example, some policies will only pay out a claim after a deductible has been reached. A broad range of products are available on the market to meet everyone’s needs.

It is worth noting that pet insurance is different from a pet wellness plan, which is also often offered by many insurers. Whereas pet insurance helps protect policy holders from unexpected expenses as a result of a pet injury or illness, wellness plans (sometimes called preventative plans) provide plan members with reimbursements for routine procedures that a pet will need. Examples of such procedures covered by preventative plans include physical exams, vaccinations, dental cleaning, etc. On the other hand, pet insurance covers treatment for unexpected circumstances such as broken leg, foreign body ingestion, cancer, etc. The scope of this note is on pet insurance.

Although the products offered by operators are fundamentally the same at the core, slight modifications are made to give customers a variety of options to choose from. For example, customers might be given different deductible options or products might have different annual limits. Many variations of pet insurance exist in the market.

Majority of the policies sold today (98%) are products that provide coverage for both accidents and illnesses. This is a contrast to the old days when coverage for accidents and illnesses was sold separately. Most policies offered today mainly cover household pets such as dogs and cats. Some operators, such as Nationwide, also offer coverage for exotic pets. Policies for dogs tend to dominate both industry policy volumes and revenues. In 2019, policies for dogs accounted for ~63% of industry premiums, while policies for cats accounted for the remaining ~37%. Policies for other species, including birds and exotics, account for a marginal portion of industry premiums. Dogs are generally more expensive to cover than other pets. For example, according to the American Pet Products Association, surgical vet visits cost dog owners $621 a year, compared with $382 for cat owners. Similarly, routine vet visits cost dog owners $231 a year, compared with $193 a year for cat owners.

It is estimated that there are over 180 million cats and dogs in North America, and over 120 million of these pets visit the vet annually. As more expensive and sophisticated treatments, including radiation therapy, CT scans, transplants and chemotherapy, gain acceptance, the pet insurance industry is poised to experience rapid growth.

The big opportunity

Today, there remains a noteworthy divergence in pet insurance market penetration between Europe and North America. Less than 3% of pets in North America are covered by pet insurance, whereas more than 20% of pets are insured in several European markets. As the pioneer of pet insurance, Sweden leads with ~40% of pets in the country having some form of insurance, followed by the U.K with ~25%.

The lack of adoption in the North American markets is primarily driven by lack of awareness and the shady historic reputation of insurance that continues stick around. When pet insurance was first introduced in North America, many of the products sold were not very customer-friendly. Insurance providers often dropped sick pets or had a long list of excluded conditions, resulting in wide-spread horror stories that left many policy holders feeling like victims of bait-and-switch tactics. Consumer choice was also limited, further impeding adoption. If you live in North America, just ask yourself how you feel about any form of insurance - you’ll understand where the resistance to such products stems from.

In addition, many traditional industry players tend to be small business units within large financial services companies. As a result, there has not been much of a dedicated focus to drive adoption and awareness. A good example of this is the case of ASPCA Pet Health Insurance discussed in the following section.

Psychology also plays a role in the lack of adoption. Similar to how all drivers think they are good drivers or how all investors think they are better than average, pet owners have a tendency to think their pets are unlikely to get severely sick or injured. This conceitedness often leads pet owners to underestimate the cost of pet care, resulting in sub-optimal decisions being made at a later time (e.g., economic euthanasia). In reality, it is impossible to know whether your pet is “lucky” or “unlucky”. Additionally, no one gets canceled if he or she skips out on pet insurance or puts down a pet in order to avoid a financial burden. The combination of these societal trends has kept demand for pet insurance low.

Over the past two decades however, new players with offerings that are customer-centric have emerged. These new players offer greater flexibility, efficient claims processes, and lower prices. These players have also been deploying meaningful amounts of capital to repair the stained reputation of pet insurance and raise awareness. These shifting industry dynamics may just mark the pivotal moment at which pet insurance penetration balloons.

Competitor landscape

In 2020, North American industry revenues sat around $2B, but given the trends noted earlier, these figures are expected to grow rapidly over the coming decade. Nationwide remains the market leader, followed by Trupanion, Petplan Pet Insurance, and Crum & Forster Pet Insurance Group, representing a market share of 47%, 23%, 9%, and 5% respectively. Nationwide’s market dominance derives from its time in the market and its broad product portfolio. Recall that Veterinary Pet Insurance (VPI), a subsidiary of Nationwide, wrote the first North American pet insurance policy in 1982. Nationwide was also the first company to introduce routine care coverage, as well as the first to offer broad coverage for birds and exotic pets. Other noteworthy providers include Embrace Pet Insurance, Healthy Paws, and PetFirst Healthcare. While market concentration continues to remain high among the top 4 players, there has been an uptick in the number of new players entering the market, given the overall industry prospects and attractiveness. As such, intensity of competition will continue to rise and general profitability will taper at some point.

New entrants into the space are likely to be other financial services companies with large pools of capital to deploy. There are various approaches these firms can take to enter the market, including through strategic partnerships, underwriting agreements, or newly formed entities. Only those players that can navigate the regulatory hurdles can find success in the industry. Market entrants must also be capable of building industry relationships and setting up distribution networks. Note that most players offer a variation of the same basic product. As a result, operators compete mainly on the basis of price, a factor that can prevent smaller-scale players from entering the market. Given the current concentration of market share among the top 4 players, incumbents greatly benefit from economies of scale, with the average cost per policy declining as volumes rise. Combined with the range of services offered by the large players, which enables them to capture premiums from a broader range of clients, newly formed upstarts usually have to fight an uphill battle to capture market share.

Property and casualty (P&C) insurers, life/health insurers, and group benefits providers are the prime candidates to enter the market in some form. These firms have the scale and experience needed to efficiently manage claims, tackle the regulatory challenges, and quickly launch a distribution network. For a P&C insurer, pet insurance is a compelling business to scale up given the attractive loss ratios. The loss ratio represents the percentage of earned premiums paid out as claims, and lower loss ratios tend to benefit average profitability. Although denoted as a P&C business in the eyes of the law, pet insurance sectorial loss ratios typically remain below 55%. These metrics compared to the general P&C industry loss ratios, which tend to exceed 60%, highlight the attractiveness to the industry. While the loss ratios are attractive, general industry margins have remained significantly below those of the broader P&C industry. This trend is largely explained by the difference in the life cycles of the two industries.

For group benefits providers and other types of insurers (e.g. life, health, etc.), pet insurance remains interesting because the risks and trends tend to be more aligned with the health insurance market. These companies already have the foundations and frameworks in place to dive into the market. In addition, leveraging their existing relationships with employers, these companies can quickly ramp up distribution to capture market share.

While the industry remains attractive, success is highly dependent on the efficient execution of several initiatives. For example, ASPCA Pet Health Insurance (a subsidiary of the Crum and Forster group, a Fairfax company) has been present in the market for decades. In addition, the company has a long history of working to prevent animal cruelty, a factor that has helped enhance its brand awareness. Despite these competitive advantages, it has failed to keep pace with the industry's sharp revenue growth over the past few years. This is primarily due to the ancillary nature of pet insurance to Fairfax’s many other insurance products. In fact, many of the players noted above are either small segments within large financial services or owned by private equity firms. Pet insurance remains a challenging market to capture, especially for legacy players.

The most potent form of competition to the industry actually stems from the self-funding of vet costs and pet medications among consumers. Recall that only 3% of pet owners in North America choose to get pet insurance. The remaining 97% of pet owners choose the risky route and use their credit cards to fund pet care costs. This also means that the marginal new pet owner is very much unlikely to get pet insurance, given that the majority of his or her friends, who he or she may seek advice from, do not have coverage. As a result, operators must work extremely hard to convince consumers of their value proposition. More recently, operators have been investing heavily in technology to make their case. After all, the ability to offer flexible plans with speedy claims processing, at the lowest prices, might just convince the self-funders.

Buying pet insurance

Pet insurance can often be purchased online with a few clicks. As one would expect, many pet insurers expend large portions of revenue on advertising as a means of increasing consumer awareness. However, solely relying on direct to consumer sources can lead to additional challenges. For instance, pet owners searching for pet insurance online may be doing so because their pet already has a problem, which could result in either adverse selection or a negative customer experience. As a result, some operators have been channelling efforts towards building industry relationships (e.g. with veterinarians, shelters, breeders, and other organizations) to help drive sales.

We will learn more about this type of sales practice when we look at Trupanion. For now, note that almost two thirds of pet owners with coverage learned about it from their vet. By building relationships at touch points at which the pet owner highly trusts the other party (e.g., vet, breeder, etc.), operators can improve the negative sentiment towards insurance.

These other parties (e.g., vets, breeders, shelters, etc.) also benefit from these relationships with operators. For example, research has shown that pet owners with pet insurance tend to visit the vet twice as more often as those without coverage. In addition, serving customers with coverage enables vets to do what they love, without being constrained by the pet owner’s finances. Commentary from vets suggests that the primary reason a pet is put down is because of economic euthanasia. Insured customers can help reduce the stress and guilt vets face on a daily basis. If executed correctly, these relationships create win-win scenarios for all the stakeholders involved.

A note about claims

When it comes to claims, much of the industry runs on a reimbursement model. This means that pet owners are usually responsible for the full amount when due. Only after the pet owner fills out paperwork and files a claim will he or she be reimbursed for the expenses incurred. As you are probably thinking, this dated claims process creates lots of friction and uncertainty for the pet owner. For instance, an insurance company could decide to deny the claim, leaving the pet owner to bear the burden.

Some companies like Trupanion have recognized this issue and have begun installing complimentary technology software at hospitals to help with practice management. For example, the Trupanion Express program is a web-based solution that enables direct billing to Trupanion. With this software, the pet owner would only be responsible for his share of the bill (e.g., deductible and other) at checkout. Trupanion would directly pay the remaining balance to the vet, within minutes. Such systems help reduce the frictions faced with the reimbursement model and greatly improve member experience, increasing the appeal of pet insurance ever so slightly.

Industry and business drivers

Analyzing the pet insurance industry requires careful monitoring of several metrics. The number of pets is obviously a pre-requisite. There are an estimated 180 million cats and dogs in North America, with 120 million of these pets visiting the veterinarian every year. In addition, an estimated 12 million puppies and kittens are born each year. As these figures increase, so does the market opportunity. Pet insurance sales also correlate with per capita disposable income levels. For many, pet ownership and the related spending represents a discretionary purchase. Therefore, fluctuations in income can have a meaningful impact on how much households allocate to spending on pets. Homeownership, which moves inline with income growth, is also a metric to monitor as it correlates with market opportunity. Studies have shown that homeowners spend nearly three times more on pets compared with renters.

Lastly, the unemployment rate is also a key metric to monitor, as employee sponsored pet care is quickly becoming an area of growth. Today, about a third of Fortune 500 companies now offer some form of voluntary pet insurance. Monitoring the trends in these metrics will give a sense of the growth to come.

In terms of costs, claims expenses represents the largest category for any operator. Recall that pet owners with insurance tend to seek care twice as more often as those without coverage - a factor that has implications on margins. Additionally it is important to note that inflation in the cost of pet care tends to be 5-10% annually, driven by the increasing acceptance of more sophisticated treatments. However, the extent of claims expenses varies considerably by company due to differing policy options. Many operators provide a myriad of policies with a range of incident limits.

Another meaningful cost category includes employee compensation. Wages represent the second largest industry expense category. As products become more complicated and as the complexity of procedures increases, wage inflation is expected to be much greater than the broader inflation rate. The need to deliver on customer service and raise awareness also means member support functions will continue to dominate employment figures. While investment in automation can help offset some costs, it is likely that industry operators will continue to experience rising wage costs given the tightening market for talent.

As noted earlier, only about 3% of pets in North America have pet insurance coverage. As a result, increasing awareness is a primary focus for many operators. This pursuit to raise awareness has in turn resulted in elevated spending on marketing, sales, and technology. Spending in these areas is expected to continue to grow as operators try to create a competitive advantage.

Trupanion (TRUP)

With an industry overview in place, we can now turn our attention to an operator that is interestingly positioned to capture the market. That business is Trupanion (TRUP) - the second biggest player in the North American pet insurance market. The following section takes a dive into the business, highlighting the unique traits of the business and my valuation.

What is Trupanion and what makes it unique?

When Darryl Rawlings, now CEO of Trupanion, was 14, his family dog, Mitzy, twisted her stomach. Faced with a similar situation as outlined in the introduction of this note, he watched his family struggle to find the funds needed to pay for the treatment. Rawlings never saw Mitzy again, but it led him to dream about creating a company that was valuable to pet owners, their pets, and veterinarians. In 1998, after selling his cigar import business for $500,000, that dream came true - Rawlings founded Trupanion in Canada, then under the name Vetinsurance. His first pet insured was his very own dog, Monty. From there, Rawlings rapidly grew the business, expanding into the U.S. market in 2005. In July 2014, Rawlings took the company public, raising $71M through its offering.

Today, Trupanion has grown to become the second largest pet insurer in North America, with over 1 million pets enrolled. The company holds a market share of ~23%, only second to the market leader, Nationwide, which holds a ~47% position. In 2020, the company reported $502M in revenue, and it is well on its way to report ~$700M for 2021. The company has also expanded its business globally, with operations in Puerto Rico and Australia. Although Trupanion began in Canada, the company now derives the majority of its business from the United States (83% in 2020). While the company has not reported a profit yet, it is likely to be profitable in the next few years, given the current growth projections.

It is difficult for a pet owner to know whether his or her pet is “lucky”, “unlucky”, or “average”. In addition, even if a pet ends up being “average” over its life, the timing of accidents or illnesses may not align with the owner’s budgeting approach. Budgeting for a pet is difficult, and there is lots of uncertainty. Trupanion helps eliminate this uncertainty by essentially having “lucky” pets subsidize “unlucky” pets. The company prides itself on its ability to pay a high percentage of its premiums in claims, compared to other players. For every $1 collected in premiums, Trupanion aims to spend 72 cents paying invoices. This higher than average payout ratio remains one of Trupanion’s key value propositions. The ~30% delta between premiums collected and dollars spent on paying invoices can be viewed as the cost of the hedge.

Trupanion also takes a unique approach in the way it develops its products. For example, unlike traditional insurers, Trupanion does not have an annual plan - premiums don’t increase just because a pet had a birthday or because of claim activity in the previous year. Instead, the core Trupanion product offers a lifetime coverage, without any payout limits, allowing a covered pet to get the care it needs. This commitment to pet owners and pets has helped the company achieve an average retention rate of 98.5%. Such a high retention rate also makes future earnings of the subscription business more predictable. Those customers that do churn usually leave within the first year - Trupanion is aware of this and continues to test ways to improve retention in this customer category.

The company also remains very transparent about its product pricing. Individual pets are first placed into a sub-category, determined by several factors, including breed, local cost of veterinary care, and age at enrolment. Next, Trupanion determines the average cost of care for a pet in that category and adds a 30% markup to determine the price of the plan. Once enrolled, the monthly cost for an individual pet will not go up based on its specific situation (unlucky pets are not penalized). Instead, Trupanion will continue to refine its sub-categories by leveraging the increasing amount of data it collects. As a result of this process, a sub-category may be split into two, causing one side to experience a pricing increase and the other to experience a decrease (in 2021, Trupanion reduced prices for 16% of pets). When Trupanion first started, it only had four sub-categories - today it has millions.

Trupanion has also pioneered the way it processes claims. Much of traditional pet insurance is based on a reimbursement model. In this model, a pet owner is first required to pay the vet out of his or her own pocket at check-out. Only after the pet owner fills out paperwork and submits a claim may he or she be reimbursed for the expenses incurred. This model creates a lot of uncertainty for the pet owner and is inefficient for all the stakeholders involved. In order to enhance its “lowest cost operator” moat, Trupanion has installed its propriety software that enables direct payment to vets at over 6,000 hospitals. This approach has helped eliminate the need for a pet owner to foot the entire cost of a treatment prior to reimbursement. This approach also improves member experience and serves as an acquisition channel. While 6,000 hospitals provides a good foundation, it only represents ~25% of the total hospital population. By the end of 2025, Trupanion expects its software penetration rate to be over 90%. In addition, the company also aspires to have 80% of claims processed automatically by 2025 (currently, only 18% of claims are processed automatically). These endeavours do not come cheap; the company expects to continue making large investments in technology to enhance experience.

Trupanion’s strategy is genius - the company has put itself in the customer’s shoes and fundamentally addressed the things people hate about insurance. These factors have enabled Trupanion to create a strong moat that is difficult to replicate. However, there is one caveat with this approach: it comes with lower margins. But with the scale Trupanion is targeting, the thinner margins might not be as concerning.

“Your margin is my opportunity”

- Jeff Bezos

The business segments

Trupanion breaks its business down into two segments: subscription business based on its core “Trupanion” product and other business. The other business is comprised of revenue from other product offerings that generally have a business-to-business relationship and different margin profiles than the subscription segment, including revenue from writing policies on behalf of third parties and revenue from other products and software solutions. Today, the majority of Trupanion’s business is derived from its direct-to-consumer monthly subscription business. In 2020, 77% of its revenues came from its subscription business and the remaining 23% was derived from its other business segment.

The subscription business currently consists of three products: its core “Trupanion” product and its recently announced Furkin and PHI Direct products. Each of these products are offered at different price points, enabling the company to reach a broader audience. The core Trupanion product offers the broadest and most comprehensive coverage and has the highest average revenue per user (ARPU). Furkin and PHI Direct products were recently announced and represent the mid-tier and the low tier ARPU segments, respectively. These new products are marketed as direct-to-consumer brands and are not sold through the company’s partners and associates.

PHI Direct is now live in the Canadian market and will soon make its way to the U.S. market. Through PHI Direct, customers can access pet insurance for as low as $10 per month for cats and $15 per month for dogs. Recall that this product is the company’s lowest ARPU offering and as a result, there are some limitations. PHI Direct offers two time limited options, Direct 5 and Direct 10, with annual benefit maximums of $5,000 or $10,000, respectively. With time limited plans, any condition that a pet is treated for in the current policy year would not be covered in the next year of coverage. Upon renewal, PHI Direct members would continue to benefit from coverage for a host of new medical conditions and accidents that a pet may experience going forward.

Furkin was also recently announced in Canada and will soon be available in the U.S. This product sits in the middle of Trupanion’s ARPU spectrum. Customers of Furkin do not have the same conditions as seen with PHI Direct, but do have a $20,000 annual limit. Customers also get access to two tele-health mobile applications to help them care for their pets. Through the Furkin product, 80% of vet fees are covered, whereas 90% are covered through the core “Trupanion” product. The Furkin product is marketed towards those who regret not getting pet insurance earlier in their pet’s life. As noted earlier, both PHI Direct and Furkin are marketed as direct-to-consumer brands and are not sold through the company’s partners and associates.

The core “Trupanion” product represents the bulk of the subscription business (PHI Direct and Furkin were just recently introduced in 2021). Offered as a monthly subscription, the product now boasts 643,395 enrolled pets, with an average retention rate of 98.5%. This core product is the company’s broadest and most comprehensive offering. As a result, it also has the highest ARPU. This product has no payout limits and does not penalize “unlucky” pets - part of Trupanion’s value proposition. Customers also get access to the company’s direct billing service, enhancing the member and vet experience. Further details on the economics of this business are provided in the operating metrics and margins section.

The other business segment consists of pet revenue that has a business-to-business (B2B) component. The businesses under this segment are pursuant to contracts for multiple pets. Under this segment, Trupanion underwrites policies on behalf of veteran affairs programs, employer sponsored programs, and other marketing companies that provide some form of health insurance for pets to consumers. In 2020, this segment accounted for 23% of revenues and had 380,831 pets enrolled. Over the last few years, this business has seen a rapid jump in enrolment. However, given the nature of this business, transactions remain highly unpredictable. In addition, margins from this business are likely to be lower than those of the subscription business.

Trupanion reaps several benefits by maintaining this presence outside of its core business. First, it gives Trupanion some skin in the game in areas the company may not have a strong foothold in. Second, and more importantly, underwriting policies for competing firms gives the company access to large amounts of data, which the company uses to better price its products and serve its members.

Territory partners and sales strategy

Trupanion strives to build a company that is valuable to pet owners, their pets, and veterinarians. For pet owners and their pets, the Trupanion product offers the best-in-class coverage that is available 24/7. For vets, although not the buyers of pet insurance, Trupanion can help them earn more. Studies have shown that pet owners with pet insurance tend to visit their vet almost twice as often and spend twice as much on care as do pet owners without insurance. In addition, serving owners with Trupanion coverage (or coverage alike) enables vets to recommend optimal treatment without having their decisions dictated by the cost of treatment and the financial burden on the pet owner. The direct billing service (Trupanion Express) offered also removes the friction and uncertainty involved when filling a claim. In fact, vets can save up to 3% with Trupanion Express, as they bypass the transaction fees typically associated with credit card payments. These factors create a strong incentive for vets to recommend Trupanion to their clients. Vets are truly pleased with these features and represent the largest source of referrals for Trupanion.

To drive relationships with vets, Trupanion relies on its Territory Partners. These individuals make frequent face-to-face visits with vets in their specified geographic location to establish long-term ties. As of 2020, Trupanion had 152 Territory Partners visiting ~20,000 hospitals every quarter. Such access to hospitals is remarkable and also an advantage difficult for a competitor to replicate. Territory Partners are not Trupanion employees, but rather, independent contractors who are compensated through a combination of referral fees for new pet enrolment and residuals tied to pet retention within their territory. Once a prospective pet owner has been educated about pet insurance through the vet, the individual can then decide to purchase insurance through Trupanion’s website or over the phone. While the pandemic created some challenges with face-to-face interactions, Trupanion plans to expand its Territory Partners network to drive growth.

Operating metrics and margins

As previously noted, Trupanion prices its products on a cost-plus basis. The company simply determines the unit costs of its products and applies a 30% markup to determine price. Over the long term, the company aims to spend 70-72% of monthly premiums collected on paying claims. Most traditional pet insurers only spend between 50-60% on invoices, a contrast that highlights the value proposition of Trupanion. The company also expects to spend ~9% of monthly premiums collected on providing support to current members (e.g. providing 24/7 fast customer service, residual payments for Territory Partners, etc.). After factoring in the ~4% of revenues that the company anticipates to spend on technology and other fixed expenses, it is left with a 15% adjusted operating margin. This adjusted surplus excludes expenses related to pet acquisition, depreciation, and stock based compensation.

Using the adjusted operating margin, we can get to the lifetime value (LTV) of a pet by calculating the product of the absolute monthly profit per unit and the average number of retention months. Given an average retention rate of 98.7%, retention months are estimated to hover around 77 months (1/(1-retention rate)). In 2020, Trupanion reported an LTV of $653, representing a 25% YoY increase.

Pet acquisition costs (PAC) can be viewed as a one-time expense involved to acquire a pet. These costs can be determined by taking the sales and marketing expenses and offsetting them by stock based compensation and sign-up fees. Sign-up fees, as the name suggests, are fees collected from new customers at enrolment. Once the PAC has been determined, we can calculate the LTV:PAC ratio. Over the last 3 years, this ratio has averaged around 2.62x. This ratio will come in handy when we try to estimate future sales and marketing expenses.

Trupanion also gives us some additional insight on its churn. Customers that cancel their subscription can be placed into three categories based on rate changes: new pets/no rate change, rate change < 20%, and rate change > 20%. As seen in the table below, cancellations on a percentage basis are highest in the first category. The company suspects that many of these cancellations stem from customers trying to get coverage for an undisclosed condition or from customers who have not fully grasped the value proposition. Going forward, the company plans to prioritize improving retention within this category. Other reasons for cancelations include the passing away of a pet. To offset the impact of cancellations or in other words, to recoup some of the PAC spent on members that cancelled, the company strives to generate referrals from friend referrals and by getting members to enrol additional pets. These referrals tend to be inexpensive in terms of acquisition costs. The company currently offsets half of its cancelations through these sources, but its true goal is to offset over 100% - something it refers to as “TruTopia”.

The margin profile of the other business segment is different from the subscription segment. In 2020, Trupanion spent 63% of revenues on paying invoices for this segment. The business also spent 29% of revenues on providing support to current members. 5% was spent on technology and other fixed expenses, leaving the segment with an adjusted operating margin of 3%. Given the nature of the other segment, the timing of business transactions can have a relatively large impact of margins and make future earnings difficult to forecast.

Future building blocks

In his 2020 shareholder letter, Rawlings outlined the company’s ambitions over the next five years. While the company has achieved tremendous growth over the past two decades, there are several avenues the company plans to pursue to take the business even further. With its foundations in place, Trupanion looks to not only continue rapidly scaling its insurance business, but also expand into new complementary product categories.

The current macro trends (i.e., humanization of pets, rising pet care costs, low market adoption of pet insurance, etc.) continue to shift in favour of the pet insurance business. Trupanion is well ahead of this trend and confidently targets to grow its core insurance business by at least 25% per year over the next 5 years. In addition, the company also looks to capture the broader pet insurance market through introduction of new products. As previously noted, the company recently announced the PHI Direct and Furkin products, both representing a lower price point than its core Trupanion product. These products are currently available in Canada and will soon be available in the United States. These products should help meet the needs of those customers who may have not gotten pet insurance when their pets were younger or those who seek the lowest cost option. Trupanion also believes that these offerings will help consumers better see the differences between offerings on the ARPU spectrum and drive penetration of the core product.

Technology is also a key enabler for Trupanion’s business. Going forward, the company will continue to ramp up its investments in this area. These investments should aid the company better price its products and help unlock cost savings through automation. The company’s goal to process 80% of claims automatically by 2025 highlights its focus on technology (currently only 18% of claims are processed automatically). In addition, as the company continues to install its software in hospitals, member and veterinarian experience should improve, in turn further enhancing the company’s moat. Trupanion is also looking at ways to sell its technology to other players in the market. The company targets to generate $100M in incremental revenue from this endeavour with 15% adjusted operating margins by 2025.

Perfecting its distribution strategy is also a key area of focus going forward, as the company tries to reach new customers and capture market share. Currently, vet referrals and member referrals source nearly 75% of new pets enrolled. One channel that can help drive additional growth is e-leads. Trupanion has exclusive relationships with IDEXX and Covetrus, the owners of 75% of practice information management systems (PIMS) in North America. PIMS are strategic because they can provide the company with access to new pet owners who make their first visit to a hospital. Trupanion estimates that this partnership can give it access to nearly 1 million leads to pursue per month. Another channel includes its exclusive relationship with State Farm. The company estimates that this partnership gives it access to over 9M+ pet owners, representing a significant opportunity for growth.

Community relationships with breeders also represents a key component of its distribution strategy. Trupanion notes that breeders have been its fastest-growing channel over the last 5 years. The breeder channel has shown to have strong lead growth, high conversion rates, and exceptional lifetime value. Going forward, the company looks to further nourish these relationships.

Trupanion also continues to test acquisition through its direct-to-consumer channels such as TV, radio and social media. In the past, the company has remained hesitant of these channels and focused on higher value channels. Less than 10% of leads are generated through this channel. Pet owners searching for pet insurance online may be doing so because their pet already has a problem, which could result in either adverse selection or a negative customer experience. However, the company realizes that these channels can be very valuable in raising awareness of its products and will continue to refine its approach.

Partnerships are also a key driver for distribution. In December 2021, Trupanion entered into a partnership with Chewy, giving the company access to Chewy’s 20 million customers. Management notes that the Chewy products are designed exclusively for Chewy and suggests that margins are closer to those of the core subscription business vs. other business. Through this partnership, Chewy will offer customers both preventative care wellness plans and comprehensive insurance plans for accidents, illnesses, and chronic conditions. In addition, it will help drive awareness within the pet parent community, simplifying the end-to-end process – from researching and purchasing pet insurance to filing, tracking, and paying for claims. Going forward, Trupanion expects to continue entering into similar partnerships to help drive growth.

Beyond its distribution strategy and technology, employer sponsored pet insurance also represents an attractive area of growth for the industry. As a result, Trupanion continues to ramp up its “Worksite Benefits” channel, targeting $100M in revenue by 2025. In 2020, the company entered a strategic alliance with Aflac worth approximately $200M under a 3-year lock-up, serving as a catalyst for growth in the employer-sponsored pet insurance space. Under this alliance, Aflac will provide Trupanion with access to its distribution platform, along with assistance in worksite product design, marketing, and enrolment support. This remains an area to keep a close eye on.

International expansion also remains top of mind for Trupanion. The company expects to enter the Japanese market over the next few years, leveraging its partnership with Aflac - Aflac serves 1 in 4 households in Japan. The company also anticipates to expand into countries such as the UK, Brazil, and potentially parts of Western Europe over the coming years. International expansion will help support the company’s bold growth ambitions.

Over the past two decades, much of the company’s focus has been on scaling its core Trupanion product. However, the company now believes it has the capacity and capabilities to expand into complimentary product lines. For example, the company recently jumped into the pet food space with the launch of Landspath. Sold directly through its vet channel, Landspath is set up to be a healthy meal subscription that Trupanion hypothesizes can increase a pet’s life by 2 years. By 2025, the company expects this business to generate revenues north of $100M.

Another complimentary product Trupanion is exploring is a GPS tracker that attaches to a pet’s collar. A third of all pets will go missing during their lifetimes. 80% of these pets will never be recovered. A GPS tracker can help owners instantly locate their lost pets using a mobile application. Given the various GPS products available on the market today (e.g., Apple AirTag), we will have to wait and see how the Trupanion GPS will stand out.

Over the coming years, we will see these new products and strategies come into fruition. The company’s market presence and reputation should support an accelerated adoption of its new products. The company is confident in its unique strategy and formula that has worked for its core Trupanion product. Leveraging the information provided thus far, we can now put a value on the company in the next section.

Valuation

Subscription business

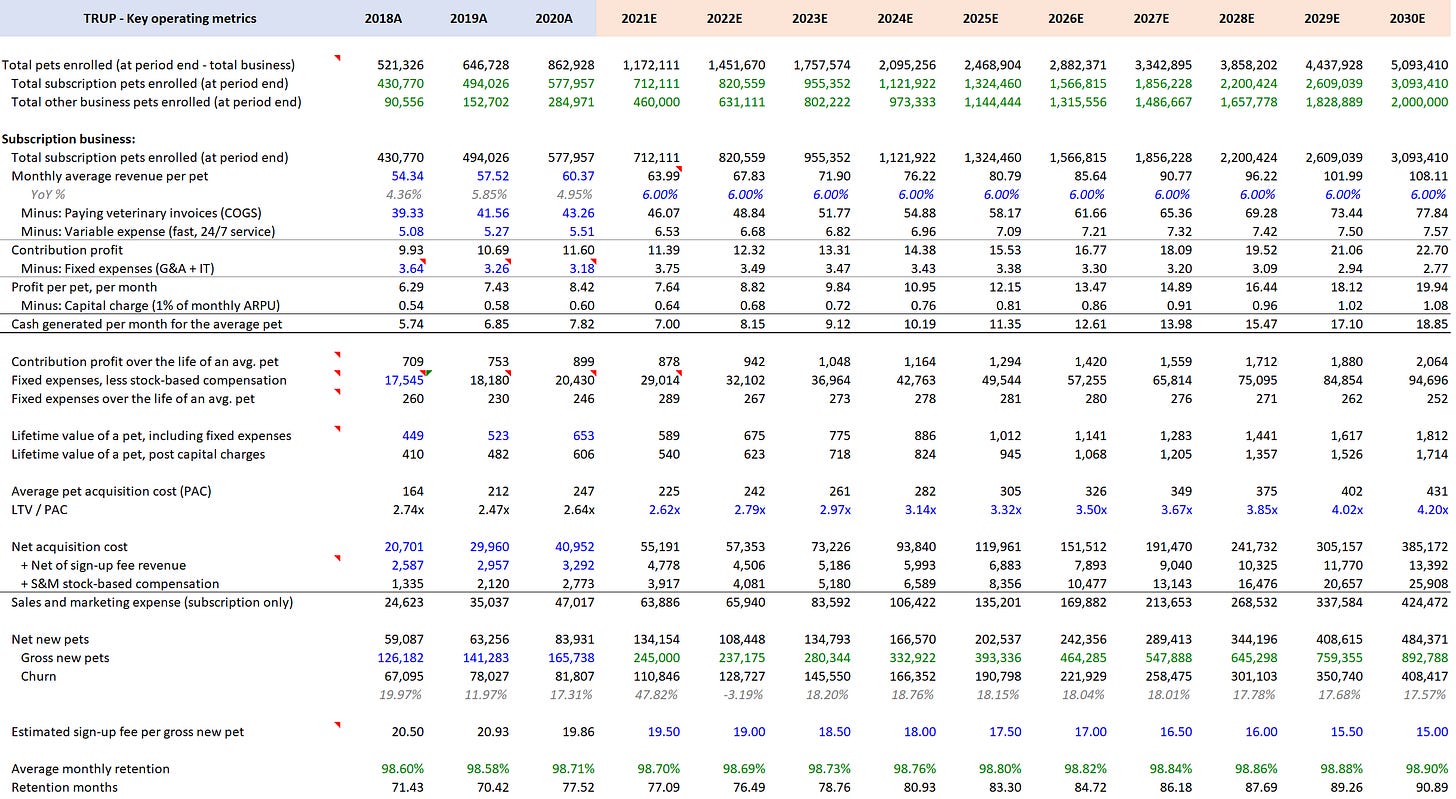

To estimate future enrolment, I point you to Rawlings’ 2019 shareholder letter in which he provides some frameworks that the company uses to make these forecasts. In short, by determining the number of pets likely to be enrolled per active hospital, we can have a view on future enrolment. Using this approach, I conclude that enrolment will likely to be ~712,000 for 2021. This represents 245,000 gross new additions for 2021. By the end of the decade, I estimate enrolments to grow to roughly 3.1M pets. Even with such annual growth, it only represents a small fraction of the addressable market. The table below provides an overview of these calculations.

Trupanion has a long history of maintaining a retention rate of above 98%. Going forward, I am confident in the company’s ability to maintain a retention rate of ~98.7%. As the company improves retention within the category with the highest churn, we may also see retention months rise to ~90 months. Investing in retention however, will put some pressure on variable expenses.

After developing a view on future subscription growth, I assumed that average revenue per user will grow at 6% annually over the next decade. Recall that inflation in the pet care space is around 5-10%+ per annum. While competition may put pressure on pricing, the introduction of new complimentary products (e.g., pet food subscription) should support ARPU. For 2021, I estimate monthly ARPU to be around $64.

In terms of margins, many of my inputs were in line with management guidance. A key value proposition of Trupanion is its promise to spend a high percentage of premiums collected on paying invoices. Referencing this commitment, it is safe to assume veterinary invoice expenses to be 72% of revenues for the foreseeable future. However, it’s important to keep in mind the comments made about inflation in the cost of care earlier. In addition, note that customers with pet insurance visit the vet more often than those who do not have coverage. Any challenges with regards to pricing could have a material impact on the company’s margins.

As Trupanion grows, it will also need to invest in member support functions to sustain its high retention rate. The company has noted that it will see costs rise in this area in the near term. However, I believe that the company’s investment in automation and self-service portals should unlock cost savings. While I have assumed a creep up in costs in the near term, I believe that by 2030 will decline to 7% of revenues.

Trupanion’s fixed expenses primarily consist of technology and development (T&D) costs and general and administrative (G&A) costs. Over the last few years, the company has consistently spent about 2% of its subscription revenues on T&D. However, the company has emphasized its need to invest in technology in the near term. The company also has a bias to build vs. buy that should be taken into account. As the company looks to expand its presence internationally, it will only be towards the end of the decade that we can expect some scale benefits to be realized. Leveraging these insights, I believe that T&D costs will continue to be ~2% of revenues going forward and slightly decline to 1% towards the end of the decade. Similarly, G&A cost are likely to creep up to 4.5% of revenues in the near term and eventually drop to 2% of revenues. These figures are also in line with management’s guidance - the company targets to spend ~5% of revenue on T&D and G&A in 2025.

Putting it all together, we get an adjusted operating margin for the subscription business that goes from 11% in 2021 to 18% at the end of the decade. This also keeps us in range of the 15% management is targeting by 2025. It is likely that we will see costs creep up in the near term, but with increasing scale, margins should improve over the longer term. Note that this adjusted surplus excludes expenses related to pet acquisition (PAC), depreciation, and stock based compensation.

To estimate PAC, I used the historical 3 year average LTV:PAC ratio to back into the PAC. The sign up fee Trupanion currently charges customers at enrolment is currently around $20. However as competition heats up, it is likely that these fees will deflate away. Towards the end of the decade, I anticipate these fees to fall to $15. With the PAC determined, we can also back into the sales and marketing expenses. The pandemic has recently led to a creep up in costs as it has been challenging for the company to meet with vets face-to-face. In addition, the market for talent also remains tight. As business complexity rises, so will costs across the entire firm. When considering this information in combination with the company’s international expansion and growth targets, it is likely that sales and marketing expenses will remain elevated in the near term. Over the longer term however, I believe the company will improve efficiency within this cost category, benefiting from scale and inexpensive referrals (e.g., friends).

Other business

The other business segment consists of pet revenue that has a business-to-business (B2B) component. Under this segment, Trupanion underwrites policies on behalf of veteran affairs programs, employer sponsored programs, and other marketing companies that provide some form of health insurance for pets to consumers. Recall that employer sponsored programs is a key area of future growth for the business. However, given the nature of this segment, the timing of business transactions can have a relatively large impact of margins and make future earnings difficult to forecast.

Using historical data as a reference point, I was able to build some assumptions for this business in the model. For 2021, I have assumed that this segment will have ~460,000 pets enrolled, representing ~40% of total enrolment. By the end of the decade, this segment could reach 2M enrolments. I believe this growth will come from the company’s initiative to capitalize on employee-sponsored pet insured, leveraging its partnerships (e.g. Aflac) to build its distribution channel. I estimate ARPU in this segment will grow at a slower pace than the direct-to-consumer business (at 4% annually). Pricing will primarily be the key sales driver in this segment. Revenues will grow from $200M to $1.4B by the end of the decade.

In terms of margins, I suspect that as Trupanion ramps up its employee-sponsored program, invoice expenses are likely to creep up closer to 70% of revenues (the company’s value proposition). As with the subscription business, we are likely to see other costs creep up in the near term and decline over the longer term, assuming the company realizes benefits from its technology investments, scale, and network. I have also accounted for the incremental margins that the company may realize by selling its proprietary software. Over the long run, I expect this business to have adjusted operating margins of ~7%.

Implied value per share

To bring it all together, I have estimated a cost of capital of 6.4% for the forecast period and 4.7% for the period beyond. This reflects the fact that as Trupanion matures, its capital profile will begin to reflect that of a mature P&C insurer. I arrive at an implied value of $92 per share. At the current market price of $130, my estimate suggests that the stock is overvalued by 30%.

With 80% out the door to service members and a business that is heavily dependent on technology, there is not much left to play with. Trupanion aims to generate a 15% adjusted operating margin over the long term. However, this figure excludes acquisition costs and other operating costs. Given that pet insurance adoption remains nascent, sales and marketing costs will remain elevated for an extended period as the company tries to raise awareness. It could be that I may have underestimated enrolments. However, I remain satisfied with 5M pets by 2030, representing a 5x increase from the current number. Trupanion is early in its lifecycle and these estimates could drastically change as we learn more about the business.

“For the investor, a too-high purchase price for the stock of an excellent company can undo the effects of a subsequent decade of favourable business developments”

- Warren Buffett

Closing remarks

Pet adoption continues to hit new records, with almost 70% of households in the United States now owning at least one pet. How we view our pets is also changing, with society treating pets more and more like humans. New technologies and discoveries are also helping our pets stay healthier and live longer. These evolving trends are now becoming pivotal growth drivers for the entire pet products and services sector.

The pet insurance space is one area that is positioned to benefit from these trends. As the cost of pet care continues to rise, awareness of pet insurance products is also rising. Some employers have also noticed these trends and are now offering pet insurance as part of their employee benefits. While pet insurance is picking up steam, only 3% of pets in North America have coverage.

There are several explanations for why pet insurance adoption has remained low in North America. Some point to the sketchy reputation of insurance, while others point to cultural norms. Whatever the reason is, it also screams opportunity.

Trupanion recognized this opportunity early on and has been on a mission to create products that are valuable to pet owners, their pets, and veterinarians. Today, it would not be wrong to refer to Trupanion as the Apple or Tesla of pet insurance. The company has taken a revolutionary approach to pet insurance, offering some of the best value in the business. The company’s high retention rate and transparency is also a reflection of its commitment.

However, the journey ahead won’t be easy. North Americans continue to remain skeptical of any form of insurance. When one gets a pet, he or she is likely to get advice from a friend - but if the friend is misinformed about pet insurance, it is likely that the newly minted pet owner will also skip out on pet insurance. Competition is also heating up within the space, adding pressure on margins. For Trupanion, a lot of things have to go right to justify its current market price. As it stands, I remain skeptical and may revisit the stock at a more attractive price.